Massachusetts Home & Flood Insurance Discounts!

Real Facts about Flood Protection

|

|

Don’t wait until water is at your doorConsider purchasing flood insurance sooner rather than later. Keep in mind that there’s often a 30-day wait after purchase for the policy to take effect. So call or write us today about flood insurance. It’s rainy day protection that could help save your most valuable investment: your home or business.

Massachusetts Coastal Flood Waters

You’ve worked hard to live the dream of owning a home or business. Most of the time, hard work, property insurance and a little luck are enough to keep both safe from harm.

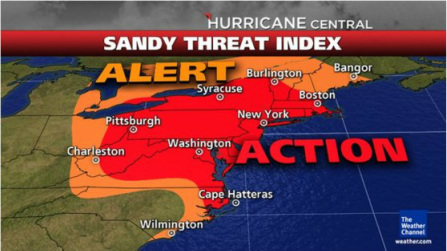

Then along comes a flood through a hurricane, rapid snow melt, new development in your area, or rain that just won’t go away. It happens more often than you might think: If your property is in what is called a “100-year floodplain”, for instance, Cape Cod, you have a one in four chance of a flood during the life of a 30-year mortgage. Greater odds than many other risks, including fire. Anywhere it rains, it can flood. A flood is a general and temporary condition where two or more acres of normally dry land or two or more properties are inundated by water or mudflow. Many conditions can result in a flood: hurricanes , overtopped levees, outdated or clogged drainage systems and rapid accumulation of rainfall.

|

Flood-hazard maps have been created to show different degrees of risk for your community, which help determine the cost of flood insurance. The lower the degree of risk, the lower the flood insurance premium.

Just because you haven't experienced a flood in the past, doesn't mean you won't in the future. Flood risk isn't just based on history, it's also based on a number of factors: rainfall, river-flow and tidal-surge data, topography, flood-control measures, and changes due to building and development.

You realize your flood insurance policy is about to expire and you’re on the fence about renewing: It hasn’t flooded in your area in years (or ever). And you really could use that extra money to buy something you really want.

But Wait!

DON’T. RISK. IT.

FACT: Flooding is the most common natural disaster in the United States, affecting every region and state, including yours.

FACT: Flood insurance can be the difference between recovering and being financially devastated.

FACT: The damage from just one inch of water can cost more than $20,000.

FACT: If you allow your flood insurance policy to lapse for either more than 90 days, or twice for any number of days, you may be required to provide an Elevation Certificate (if you don't have one), and you may no longer be eligible for policy rate discounts you might have been receiving prior to the policy lapse. It's important to talk with your insurance agent before canceling or not renewing the policy.

FACT: You can file a flood claim even if there is not a Presidential Disaster Declaration.

FACT: Flood damage is not typically covered by homeowners insurance.

FACT: No home is completely safe from potential flooding devastation—why risk it?

FACT: If you live in a high risk flood zone, and you've received federal disaster assistance in the form of grants from FEMA or low-interest disaster loans from the U.S. Small Business Administration (SBA) following a Presidential Disaster Declaration, you must maintain flood insurance in order to be considered for any future federal disaster aid.

FACT: Storms are not the only cause of floods. Flooding can be caused by dams or levees breaking, new development changing how water flows above and below ground, snowmelt and much more.

FACT: Too often, Americans are caught off guard by the emotional and financial costs of flood damage.

Check out your state's flood history with FEMA's data visualization tool. By rolling your cursor over each county, you can see how many flooding events have happened and learn more about the cost of flooding.

Flood insurance helps more: Check out your state's flood history with FEMA's interactive data visualization tool. Roll your cursor over each county to see how many flooding events have happened. The tool allows you to compare how much FEMA and the U.S. Small Business Administration have provided in terms of federal disaster aid after Presidential Disaster Declarations to the amount the National Flood Insurance program has paid to its policyholders. It's easy to see that having flood insurance provides a lot more help for recovery.

But Wait!

DON’T. RISK. IT.

FACT: Flooding is the most common natural disaster in the United States, affecting every region and state, including yours.

FACT: Flood insurance can be the difference between recovering and being financially devastated.

FACT: The damage from just one inch of water can cost more than $20,000.

FACT: If you allow your flood insurance policy to lapse for either more than 90 days, or twice for any number of days, you may be required to provide an Elevation Certificate (if you don't have one), and you may no longer be eligible for policy rate discounts you might have been receiving prior to the policy lapse. It's important to talk with your insurance agent before canceling or not renewing the policy.

FACT: You can file a flood claim even if there is not a Presidential Disaster Declaration.

FACT: Flood damage is not typically covered by homeowners insurance.

FACT: No home is completely safe from potential flooding devastation—why risk it?

FACT: If you live in a high risk flood zone, and you've received federal disaster assistance in the form of grants from FEMA or low-interest disaster loans from the U.S. Small Business Administration (SBA) following a Presidential Disaster Declaration, you must maintain flood insurance in order to be considered for any future federal disaster aid.

FACT: Storms are not the only cause of floods. Flooding can be caused by dams or levees breaking, new development changing how water flows above and below ground, snowmelt and much more.

FACT: Too often, Americans are caught off guard by the emotional and financial costs of flood damage.

Check out your state's flood history with FEMA's data visualization tool. By rolling your cursor over each county, you can see how many flooding events have happened and learn more about the cost of flooding.

Flood insurance helps more: Check out your state's flood history with FEMA's interactive data visualization tool. Roll your cursor over each county to see how many flooding events have happened. The tool allows you to compare how much FEMA and the U.S. Small Business Administration have provided in terms of federal disaster aid after Presidential Disaster Declarations to the amount the National Flood Insurance program has paid to its policyholders. It's easy to see that having flood insurance provides a lot more help for recovery.

Arthur D. Calfee Insurance Agency, Inc. is proudly serving primary home, vacation home, auto, collector car, business, general liability, property, professional liability, contractor's liability, worker's comp, key man, whole life, term life, group or personal disability, & long-term care insurance policies to patrons in the following Cape Cod, Massachusetts towns, communities and villages: Barnstable, Bourne, Brewster, Buzzards Bay, Centerville, Chatham, Cotuit, Craigville, Dennis, Eastham, Falmouth, Hatchville, Harwich, Hyannis, Hyannisport, Marstons Mills, Mashpee, Orleans, Osterville, Provincetown, Sandwich, Truro, Wellfleet, Woods Hole, Yarmouth, and Yarmouthport.